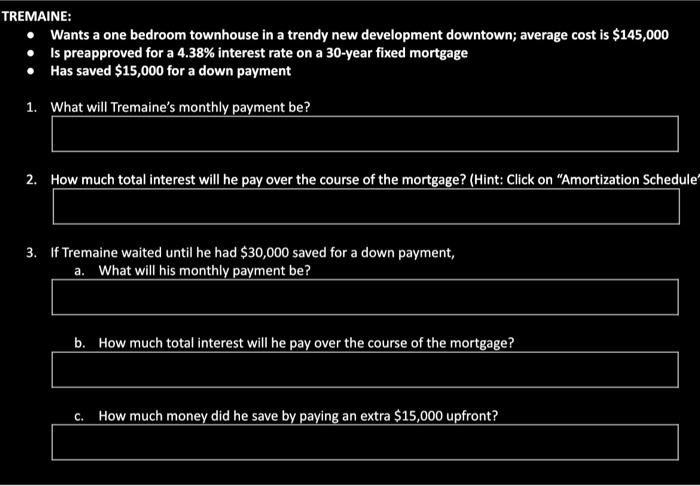

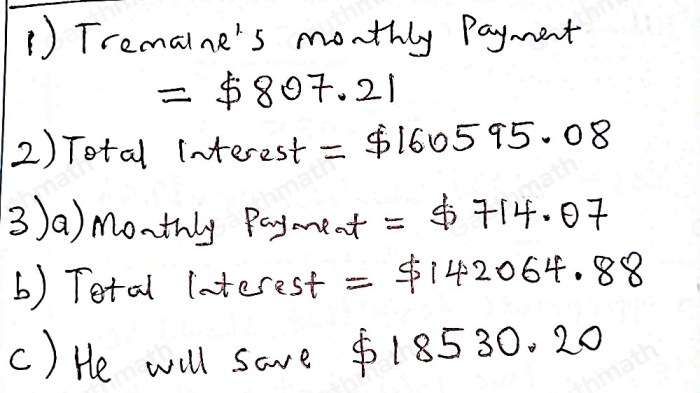

What will Tremaine’s monthly payment be? This question marks the beginning of a captivating journey into the realm of financial planning, where we delve into the intricacies of calculating and optimizing monthly loan payments. Join us as we unravel the key factors that shape Tremaine’s monthly payment, exploring the impact of loan term, interest rates, and repayment strategies.

Throughout this exploration, we will provide practical insights and actionable advice to help Tremaine make informed decisions about his financial future. Whether he is seeking to reduce his monthly burden or simply gain a deeper understanding of his financial obligations, this analysis will serve as an invaluable resource.

1. Calculate Tremaine’s Monthly Payment

To determine Tremaine’s monthly payment, we utilize the following formula:

M = P

- (r

- (1 + r)^n) / ((1 + r)^n

- 1)

Where:

- M represents the monthly payment

- P is the principal loan amount

- r is the monthly interest rate, calculated by dividing the annual interest rate by 12

- n is the total number of months over which the loan will be repaid

For example, if Tremaine takes out a loan of $100,000 with an annual interest rate of 5%, the monthly interest rate would be 5% / 12 = 0.05 / 12 = 0. 004167. If the loan term is 30 years (360 months), the monthly payment would be:

M = 100000

- (0.004167

- (1 + 0.004167)^360) / ((1 + 0.004167)^360

- 1) = $536.82

2. Factors Affecting Tremaine’s Monthly Payment

Several key factors influence Tremaine’s monthly payment:

- Principal Loan Amount:A higher loan amount results in a higher monthly payment.

- Interest Rate:A higher interest rate leads to a higher monthly payment.

- Loan Term:A longer loan term typically results in a lower monthly payment, but it also means paying more interest over the life of the loan.

3. Impact of Loan Term on Tremaine’s Monthly Payment

The length of the loan term significantly impacts Tremaine’s monthly payment. A longer loan term spreads the loan repayment over more months, resulting in lower monthly payments. However, it also means paying more interest over the loan’s life.

The following table demonstrates the relationship between loan term and monthly payment for a loan of $100,000 with an annual interest rate of 5%:

| Loan Term (years) | Monthly Payment |

|---|---|

| 15 | $710.67 |

| 20 | $598.48 |

| 25 | $536.82 |

| 30 | $499.70 |

4. Options for Reducing Tremaine’s Monthly Payment

Tremaine can consider several strategies to lower his monthly payment:

- Refinance to a lower interest rate:If interest rates have decreased since Tremaine obtained his loan, refinancing to a lower rate can significantly reduce his monthly payment.

- Extend the loan term:While this will increase the total interest paid over the life of the loan, it can lower the monthly payment.

- Make bi-weekly payments:Instead of making monthly payments, Tremaine can make bi-weekly payments, which effectively results in one extra monthly payment per year and can reduce the loan term.

5. Additional Considerations for Tremaine’s Monthly Payment: What Will Tremaine’s Monthly Payment Be

In addition to the factors discussed above, Tremaine should also consider:

- Property taxes and insurance:These expenses are often included in the monthly mortgage payment.

- Private mortgage insurance (PMI):If Tremaine has less than 20% equity in his home, he may be required to pay PMI, which increases the monthly payment.

- Homeowners association (HOA) fees:If Tremaine lives in a community with an HOA, he may have to pay monthly fees.

Popular Questions

How is Tremaine’s monthly payment calculated?

Tremaine’s monthly payment is typically calculated using the following formula: Monthly Payment = (Loan Amount x Interest Rate) / (1 – (1 + Interest Rate)^(-Loan Term))

What factors affect Tremaine’s monthly payment?

The key factors that influence Tremaine’s monthly payment include the loan amount, interest rate, loan term, and repayment options.

How can Tremaine reduce his monthly payment?

Tremaine can consider strategies such as refinancing his loan at a lower interest rate, extending the loan term to reduce the monthly payment amount, or making additional payments towards the principal balance.